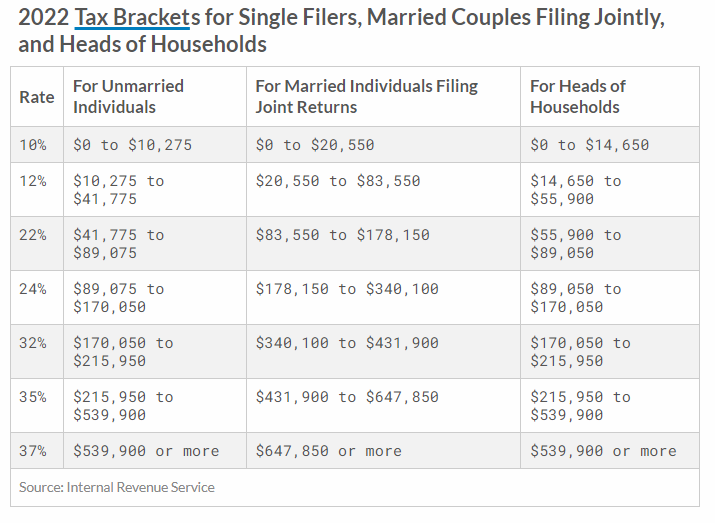

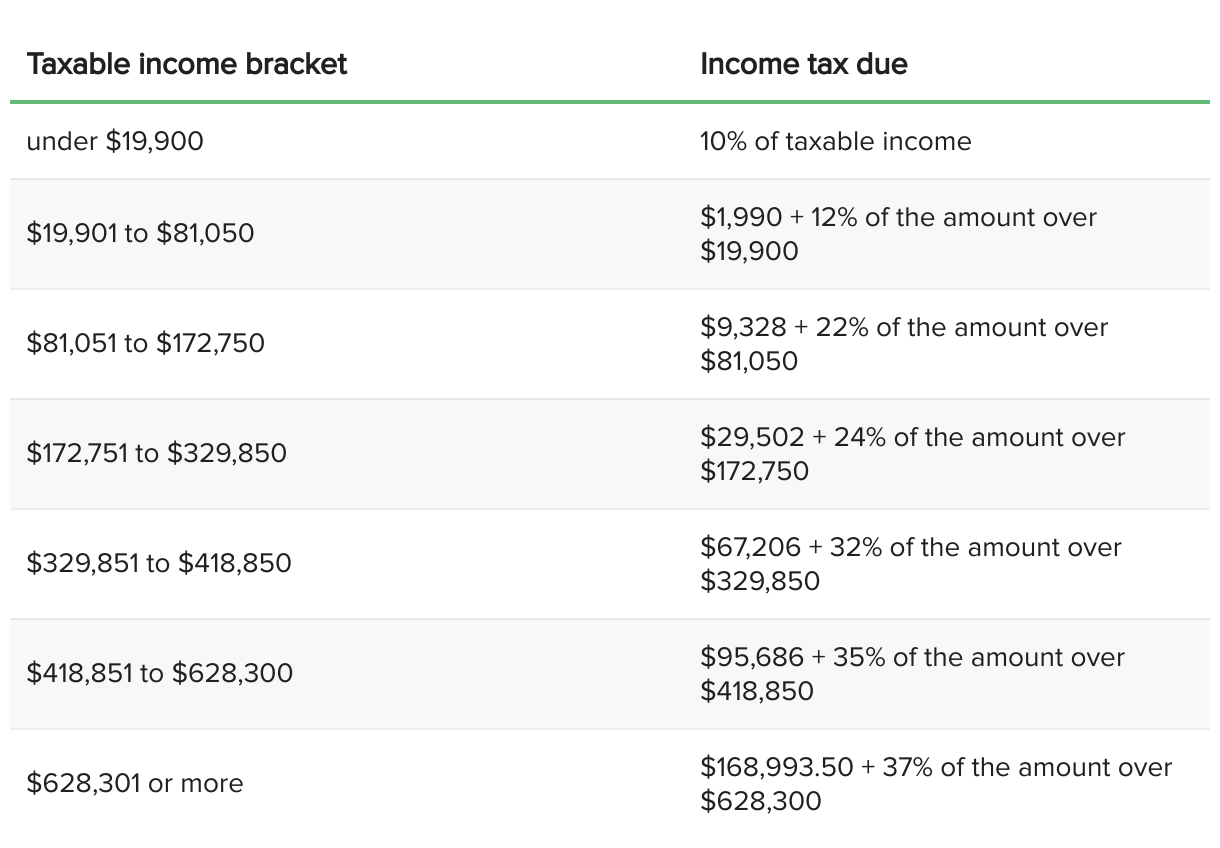

2022 tax brackets

See it in action. The seven tax rates remain unchanged while the income limits have been adjusted for inflation.

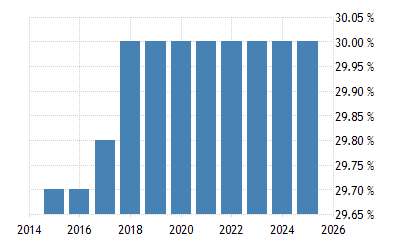

Germany Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

Working holiday maker tax rates 202223.

. Income Tax rates and bands. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year 2022 due April 15 2023. Utah tax forms are sourced from the Utah income tax.

Steffen noted that a married couple earning 200000 in both 2022 and 2023. The 2022 tax brackets affect the taxes that will be filed in 2023. Each of the tax brackets income ranges jumped about 7 from last years numbers.

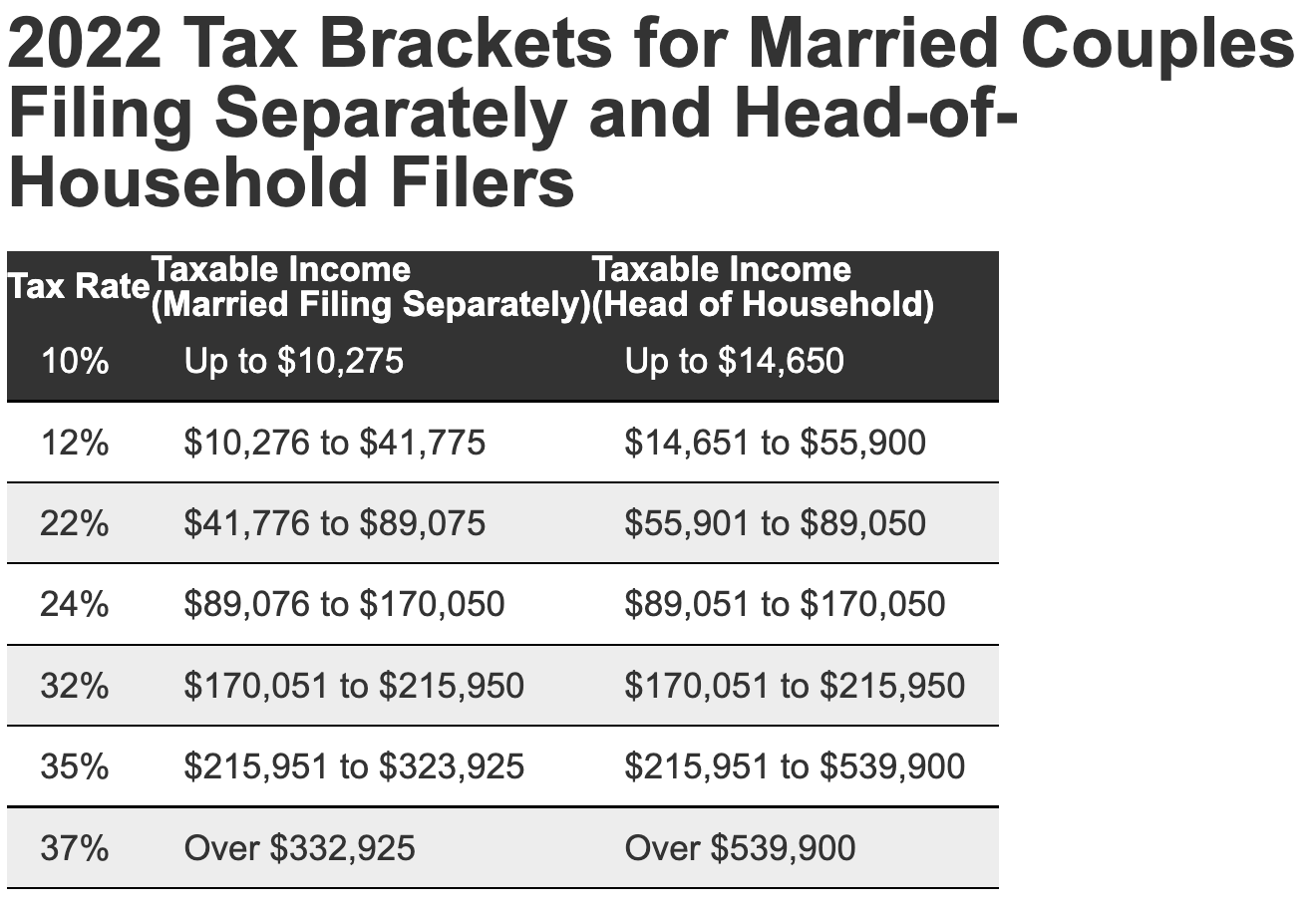

Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts. Tax on this income. Many states do not release their current-tax-year 2021 brackets until the beginning of the following year and the IRS releases federal tax brackets for the current year between.

2022 tax brackets are here. Ad Compare Your 2022 Tax Bracket vs. Ad See If You Qualify For IRS Fresh Start Program.

There are seven federal income tax rates in 2023. 2021 federal income tax brackets for taxes due in April 2022 or in October 2022. The seven brackets remain the same next year 10 12 22 24 32 35 and 37 which were set after the 2017 Tax Cuts and Jobs ActThese will be in place through the 2025.

Get help understanding 2022 tax rates and stay informed of tax changes that may affect you. There are seven federal income tax rates in 2022. Married Individuals Filing Joint Returns.

Discover Helpful Information And Resources On Taxes From AARP. Download the free 2022 tax bracket pdf. 53325 plus 45 cents for.

Federal income tax brackets were last changed one year ago for. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The IRS recently released the new tax brackets and standard deduction amounts for the 2022 tax year the tax return youll file in 2023.

Up from 20550 in 2022. All of our bracket data and tax rates are updated yearly from the IRS and state revenue departments. 1 day agoForty-year high inflation has driven up the standard deduction for 2023 as well as the tax brackets earned income tax credit and more.

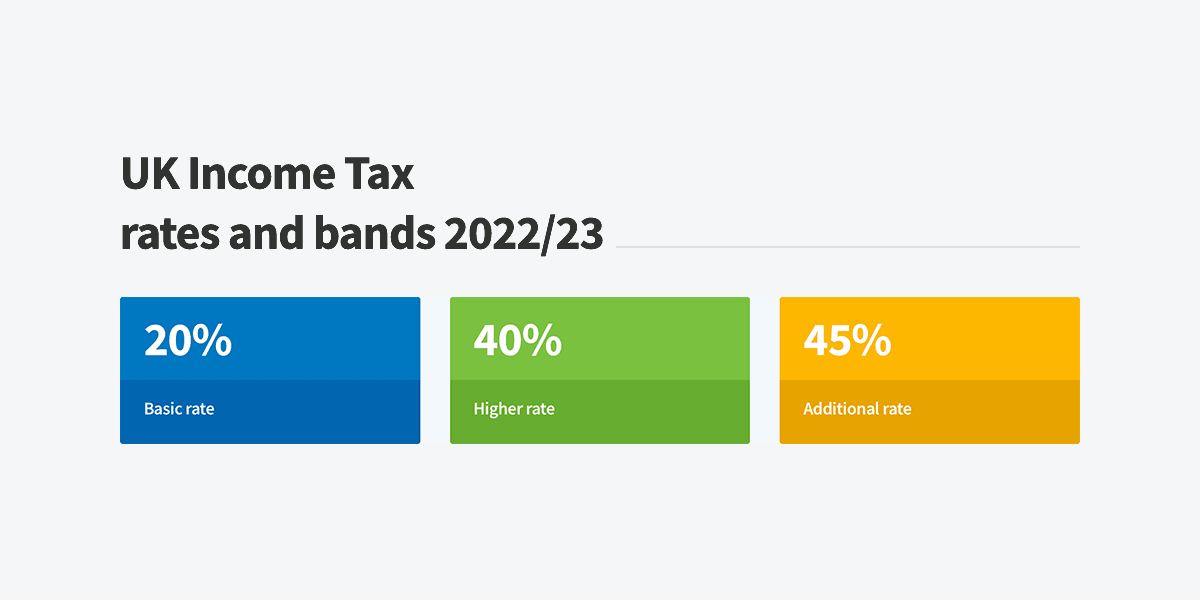

The current tax year is from 6 April 2022 to 5 April 2023. However since the income. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

31125 plus 37 cents for each 1 over 120000. The table shows the tax rates you pay in each band if you have a standard Personal Allowance of 12570. Tax brackets and rates for the 2022 tax year as well as for 2020 and previous years are elsewhere on this page.

Before the official 2022 Utah income tax rates are released provisional 2022 tax rates are based on Utahs 2021 income tax brackets. Lets review the standard deduction amounts for 2021. 20 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430.

1 day agoTax agency wants to avoid bracket creep or when workers get pushed into higher tax brackets due to inflation. 1 hour agoFor the 2022 tax year youll only be taxed 10 of your income up to a maximum of 10275 after which it would be taxed at 12 for a maximum of 41775 and so on. Based On Circumstances You May Already Qualify For Tax Relief.

19 hours ago2022 tax brackets for individuals. 23 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. Ad Avalara AvaTax lowers risk by automating sales tax compliance.

2023 tax brackets. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The 24 bracket for the couple.

The 2022 state personal income tax brackets are updated from the Utah and Tax Foundation data. These are the 2021 brackets. The income brackets though are adjusted slightly for inflation.

Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for married couples filing jointly. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Working holiday maker tax rates 202223.

This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax rates was due in April 2022. Avalara calculates collects files remits sales tax returns for your business. Your 2021 Tax Bracket To See Whats Been Adjusted.

Heres a breakdown of last years income and rates. You can work with a financial advisor who specializes in taxes to craft a. Free Case Review Begin Online.

Up from 6935 for tax year 2022.

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

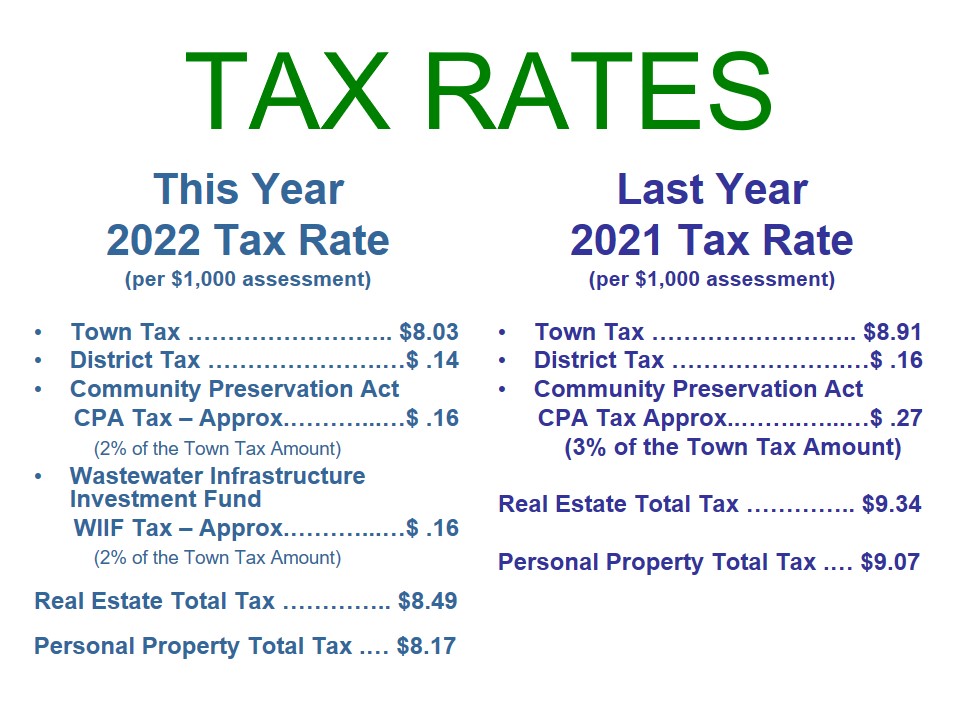

Fiscal Year 2022 Tax Rate Town Of Mashpee Ma

2022 Tax Brackets Internal Revenue Code Simplified

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Twitter এ Tax Foundation 2022 Tax Brackets Https T Co Ppudrxlsoq Https T Co Fqaga4odlw ট ইট র

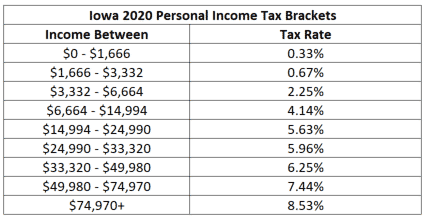

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Federal Income Tax Brackets For 2022 And 2023 The College Investor

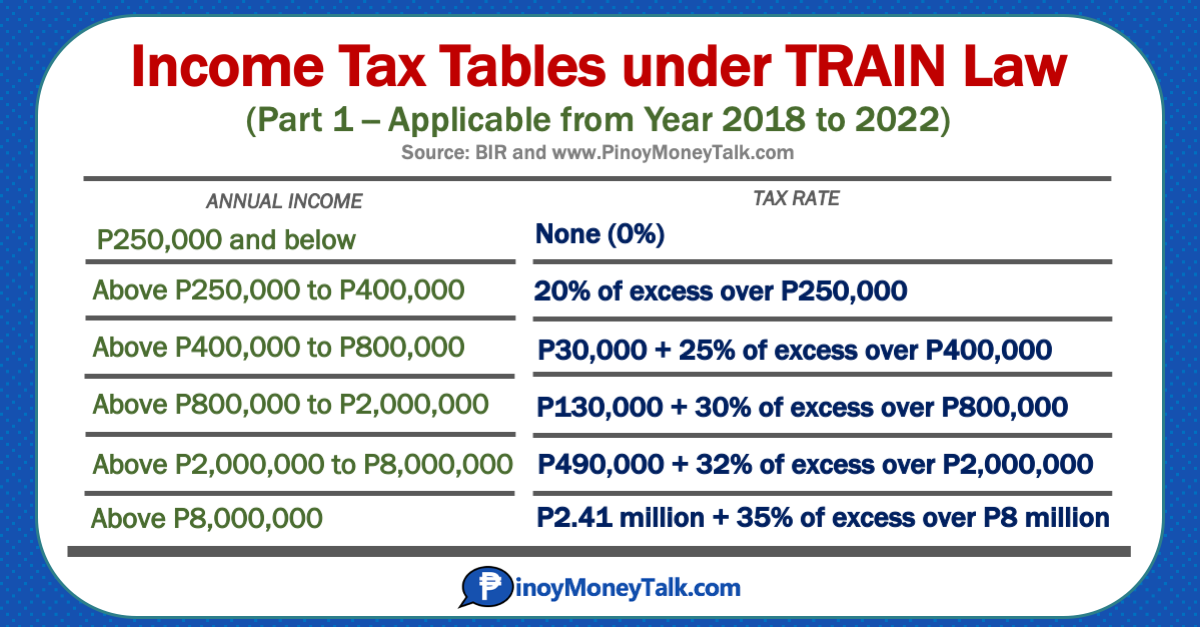

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

2022 Federal Payroll Tax Rates Abacus Payroll

What Are The Income Tax Brackets For 2022 Vs 2021

Ato Tax Time 2022 Resources Now Available Taxbanter

2021 2022 Tax Brackets And Federal Income Tax Rates

Uk Income Tax Rates And Bands 2022 23 Freeagent

2022 Tax Brackets How Inflation Will Affect Your Taxes Money

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

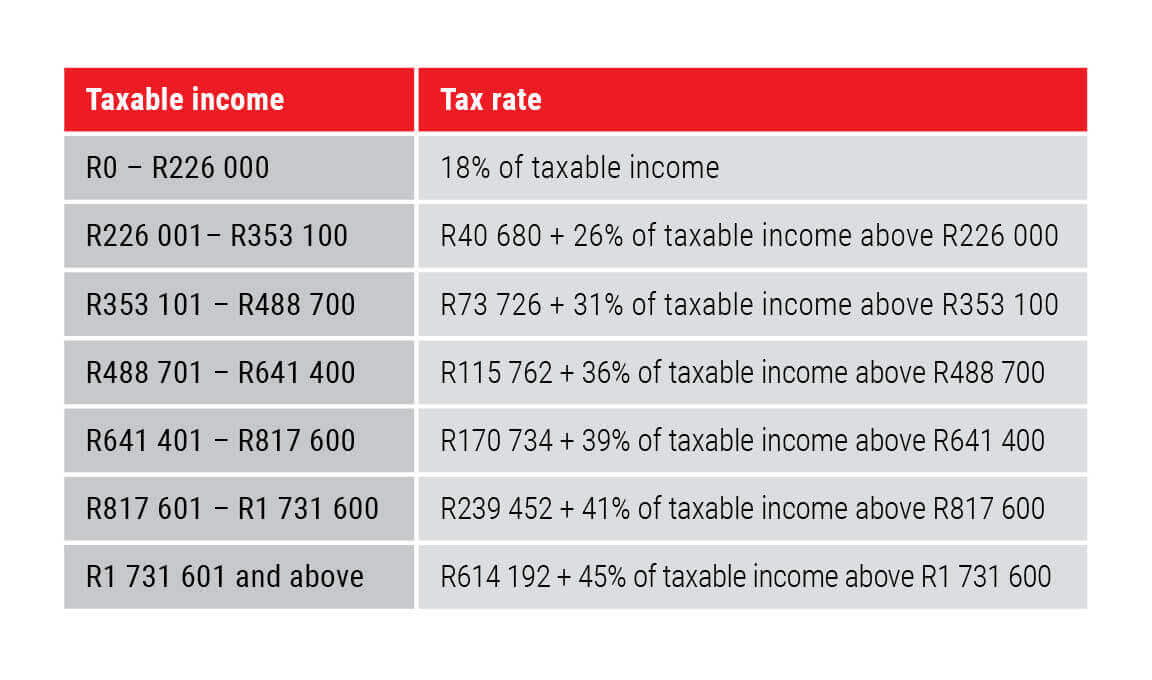

Allan Gray 2022 Budget Speech Update

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News